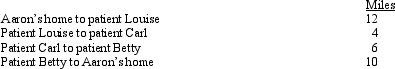

Aaron is a self-employed practical nurse who works out of his home.He provides nursing care for disabled persons living in their residences.During the day he drives his car as follows.  Aaron's deductible mileage for each workday is:

Aaron's deductible mileage for each workday is:

Definitions:

Hydrolytic Enzymes

Enzymes that catalyze the cleavage of bonds in molecules through the addition of water.

Lysosomes

Organelles containing enzymes responsible for breaking down waste materials and cellular debris within cells.

Nonfunctional Organelles

Components within a cell that are no longer active or serving their purpose.

Lysosomes

Membrane-bound organelles containing enzymes that break down waste materials and cellular debris.

Q6: In some cases it may be appropriate

Q7: Petal,Inc.is an accrual basis taxpayer.Petal uses the

Q7: Discuss the treatment of unused general business

Q17: Taylor performs services for Jonathan on a

Q55: Last year,taxpayer had a $10,000 nonbusiness bad

Q61: On June 1,2012,Norm leases a taxi and

Q78: Ramon and Ingrid work in the field

Q97: Which,if any,of the following provisions of the

Q110: Amos,a shareholder-employee of Pigeon,Inc.,receives a $400,000 salary.The

Q129: Qualifying job search expenses are deductible even