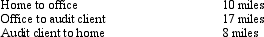

Bill is employed as an auditor by a CPA firm.On most days,he commutes by auto from his home to the office.During one month,however,he has an extensive audit assignment closer to home.For this engagement,Bill drives directly from home to the client's premises and back.Mileage information is summarized below:

If Bill spends 21 days on the audit,what is his deductible mileage?

If Bill spends 21 days on the audit,what is his deductible mileage?

Definitions:

Ethical Considerations

Factors relating to right and wrong, morality, and the principles that govern an individual's or group's behaviors.

Informed Consent

A process by which a fully informed individual voluntarily agrees to participate in a particular procedure, understanding all the risks, benefits, and alternatives.

Sexuality

The capacity for sexual feelings, a fundamental aspect of human nature encompassing sexual orientation, attractions, and behaviors.

Representative Sample

A subset of a population that accurately reflects the members of the entire population, used in statistical analysis to generalize findings.

Q2: Any § 179 expense amount that is

Q15: Leona borrows $100,000 from First National Bank

Q15: Green,Inc.,a closely held personal service corporation,has the

Q18: When interest is charged on a deficiency,any

Q25: Sid and Andrea Peterson are married and

Q41: The ad valorem tax on business use

Q63: A purchased trademark is a § 197

Q92: In 2011,Robin Corporation incurred the following expenditures

Q101: The proposed flat tax:<br>A) Would eliminate the

Q142: Generally,a closely-held family corporation is not permitted