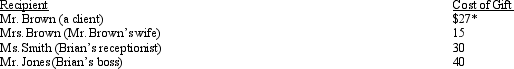

Brian makes gifts as follows:

* Includes $2 for engraving

* Includes $2 for engraving

Presuming adequate substantiation and no reimbursement,how much may Brian deduct?

Definitions:

Acquisition of Merchandise

The process of obtaining goods for sale, typically involving selection, ordering, and purchasing from suppliers.

Inventory Account

An inventory account is an account on the balance sheet that represents the value of unsold goods held by a company.

Perpetual Inventory System

A method of inventory management where updates to inventory records are made in real-time following every transaction.

Cost of Goods Sold

Cost of goods sold (COGS) represents the direct costs attributable to the production of the goods sold by a company.

Q14: In early July 2011,Gavin is audited by

Q17: For state income tax purposes,all states allow

Q22: Zeke made the following donations to qualified

Q26: James is in the business of debt

Q35: Employees of the Valley Country Club are

Q36: One of the major reasons for the

Q57: During the year,Eve (a resident of Billings,Montana)spends

Q99: Which of the following is not deductible?<br>A)

Q103: Stuart is the sole owner and a

Q155: The FICA tax (Medicare component)on wages is