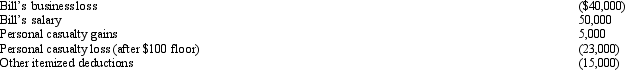

Bill,age 40,is married with two dependents.Bill had the following items for the year 2012:  Based on the above information,what is the net operating loss for Bill and his spouse for the year 2012?

Based on the above information,what is the net operating loss for Bill and his spouse for the year 2012?

Definitions:

Par Value

The nominal or face value of a bond, share of stock, or coupon as indicated on a certificate or instrument.

Dividend Rate

The amount of dividend paid per share divided by the price per share, often expressed as a percentage, indicating the returns shareholders receive for each dollar invested in the company's stock.

Date of Record

The cutoff date set by a company to determine which shareholders are eligible to receive a dividend or participate in a corporate action.

Dividend Payable

Liability showing amount of cash dividend owed.

Q10: A taxpayer takes six clients to an

Q29: Bruce,who is single,had the following items for

Q39: Joe,who is in the 33% tax bracket

Q49: Allowing a domestic production activities deduction for

Q55: As opposed to itemizing deductions from AGI,the

Q74: On July 17,2012,Kevin places in service a

Q82: On March 3,2012,Sally purchased and placed in

Q112: During the year,Martin rented his vacation home

Q124: Melinda has been referred to you by

Q126: In terms of the tax formula applicable