Essay

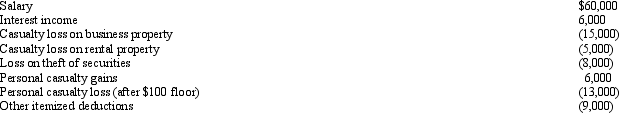

Juanita,single and age 43,had the following items for 2012:

Compute Juanita's taxable income for 2012.

Compute Juanita's taxable income for 2012.

Definitions:

Related Questions

Q23: Discuss the calculation of nonbusiness deductions for

Q49: In determining whether the support test is

Q54: Jed is an electrician.Jed and his wife

Q68: With respect to the prepaid income from

Q73: How are combined business/pleasure trips treated for

Q82: Martha participated in a qualified tuition program

Q88: Which of the following can be claimed

Q100: If an activity involves horses,a profit in

Q114: The plant union is negotiating with the

Q138: Allowing for the cutback adjustment (50% reduction