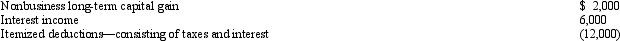

Jack,age 30 and married with no dependents,is a self-employed individual.For 2012,his self-employed business sustained a net loss from operations of $10,000.The following additional information was obtained from his personal records for the year:  Based on the above information,what is Jack's net operating loss for the current year if he and his spouse file a joint return?

Based on the above information,what is Jack's net operating loss for the current year if he and his spouse file a joint return?

Definitions:

Sales Tax

A tax imposed by governments on the sale of goods and services, calculated as a percentage of the sales price.

Proportional Rate Structure

A tax system where the tax rate remains constant regardless of the amount of income, as opposed to progressive or regressive tax structures.

Progressive Rate Structure

This is a tax system in which the tax rate increases as the taxable base amount increases, typically applied to incomes to ensure higher earners pay a greater percentage of their income.

Regressive Rate Structure

A tax system where the tax rate decreases as the taxable amount increases, placing a higher burden on lower earners relative to higher earners.

Q2: A U.S.citizen who works in France from

Q32: The tax law contains various provisions that

Q73: How are combined business/pleasure trips treated for

Q80: Tara purchased a machine for $40,000 to

Q82: Identify the factors that should be considered

Q99: The maximum cost recovery method for all

Q109: Bob lives and works in Newark,NJ.He travels

Q111: The amount of partial worthlessness on a

Q112: Characteristics of the "Fair Tax" (i.e.,national sales

Q114: The plant union is negotiating with the