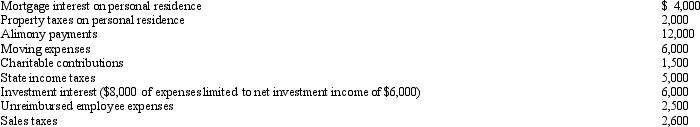

Arnold and Beth file a joint return.Use the following data to calculate their deduction for AGI.

Definitions:

Weighted-Average Method

This method calculates inventory and cost of goods sold values by averaging the costs of all goods available for sale, weighting them according to their quantities.

Labour and Overhead

Combined costs associated with the workforce (labour) and indirect expenses (overhead) necessary for production but not directly tied to specific units of product.

Process Costing System

An accounting method used where production is continuous, assigning costs to units of product based on the processes they undergo.

Weighted-Average Method

An inventory costing method that calculates the cost of ending inventory and cost of goods sold based on the average cost of all similar items in the inventory.

Q2: Qualified moving expenses of an employee that

Q13: Hazel,a solvent individual but a recovering alcoholic,embezzled

Q22: Linda delivers pizzas for a pizza shop.On

Q27: Two years ago,Gina loaned Tom $50,000.Tom signed

Q37: The alimony recapture rules are intended to:<br>A)

Q58: For income tax purposes,excess capital losses of

Q58: Discuss the criteria used to determine whether

Q62: Iris collected $100,000 on her deceased husband's

Q66: Which of the following must be capitalized

Q93: For dependents who have income,special filing requirements