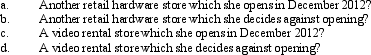

Gladys owns a retail hardware store in Tangipahoa.She is considering opening a business in Hammond,a community located 25 miles away.She incurs expenses of $60,000 in 2012 in investigating the feasibility and desirability of doing so.What amount can Gladys deduct in 2012 if the business is:

Definitions:

Project Execution Phase

The stage in project management where the plan is put into action and the work required is performed.

Project Sponsor

An individual or group that provides financial resources for a project and supports its initiation, planning, and execution.

Day-to-day Operations

Routine activities and tasks that are conducted on a regular basis to ensure the smooth functioning of an organization or project.

Commodity Items

Basic goods that are interchangeable with other goods of the same type and useful in commerce or trade.

Q25: On November 1,2012,Bob,a cash basis taxpayer,gave Dave

Q26: For tax purposes,married persons filing separate returns

Q26: LD Partnership,a cash basis taxpayer,purchases land and

Q31: If a business retains someone to provide

Q52: The taxable portion of Social Security benefits

Q57: The IRS will not issue advanced rulings

Q69: Property used for the production of income

Q70: The taxpayer's marginal tax bracket is 25%.Which

Q84: Section 119 excludes the value of meals

Q123: Tickets to a theater performance or sporting