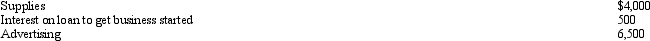

Priscella pursued a hobby of making bedspreads in her spare time.Her AGI before considering the hobby is $40,000.During the year she sold the bedspreads for $10,000.She incurred expenses as follows:  Assuming that the activity is deemed a hobby,how should she report these items on her tax return?

Assuming that the activity is deemed a hobby,how should she report these items on her tax return?

Definitions:

Type A Personality

A personality trait characterized by high levels of competitiveness, self-imposed stress, and a constant sense of urgency.

Cardiovascular Disease

A general term for conditions affecting the heart and blood vessels, often related to atherosclerosis or the buildup of plaques within arteries.

Hostility And Anger

Emotional states or attitudes characterized by antagonism and aggressive feelings towards others, which can negatively impact personal relationships and health.

Intake Of Fruits

The consumption of fruit as part of one's diet, important for getting essential nutrients and fibers.

Q35: Adjusted gross income (AGI)appears at the bottom

Q52: Denny was neither bankrupt nor insolvent but

Q62: Lois,who is single,received $9,000 of Social Security

Q64: Nicole's employer pays her $150 per month

Q72: Alma is in the business of dairy

Q73: For the past few years,Corey's filing status

Q82: Under the check-the-box Regulations,a multi-owner entity that

Q85: On June 1,2012,Gabriella purchased a computer and

Q91: Alexis (a CPA and JD)sold her public

Q109: If an item such as property taxes