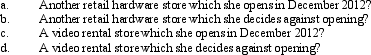

Gladys owns a retail hardware store in Tangipahoa.She is considering opening a business in Hammond,a community located 25 miles away.She incurs expenses of $60,000 in 2012 in investigating the feasibility and desirability of doing so.What amount can Gladys deduct in 2012 if the business is:

Definitions:

Micro-

A prefix denoting a factor of one millionth, or pertaining to small, often microscopic, phenomena.

Divided

Separated into parts or pieces; often referring to opinions, countries, or territories.

Amoxicillin

A broad-spectrum antibiotic used to treat various bacterial infections by inhibiting cell wall synthesis.

Medicine

The science and practice of diagnosing, treating, and preventing disease, aimed at enhancing health and well-being.

Q29: Alvin is the sole shareholder of an

Q40: The basis of an asset on which

Q66: The exclusion for health insurance premiums paid

Q67: Norm's car,which he uses 100% for personal

Q85: If the employer provides all employees with

Q88: Because graduate teaching assistantships are awarded on

Q108: Maria,who is single,had the following items for

Q109: Under the alimony rules:<br>A) The income is

Q113: A U.S.citizen worked in a foreign country

Q123: The stock of Eagle,Inc.is owned as follows:<br>