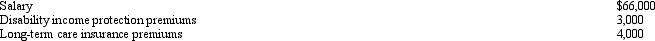

James,a cash basis taxpayer,received the following compensation and fringe benefits in 2012:  His actual salary was $72,000.He received only $66,000 because his salary was garnished and the employer paid $6,000 on James's credit card debt he owed.The wage continuation insurance is available to all employees and pays the employee three-fourths of the regular salary if the employee is sick or disabled.The long-term care insurance is available to all employees and pays $150 per day towards a nursing home or similar facility.What is James's gross income from the above?

His actual salary was $72,000.He received only $66,000 because his salary was garnished and the employer paid $6,000 on James's credit card debt he owed.The wage continuation insurance is available to all employees and pays the employee three-fourths of the regular salary if the employee is sick or disabled.The long-term care insurance is available to all employees and pays $150 per day towards a nursing home or similar facility.What is James's gross income from the above?

Definitions:

Exclusive Union

A labor union agreement that requires a company to hire only workers who are already union members.

Labor Union

An organization representing workers' interests, focusing on negotiating wages, work hours, and working conditions with employers.

Wage Rates

The amount of compensation individuals receive in exchange for their labor per unit of time, such as hourly or annual earnings.

Bilateral Monopoly

A market in which there is a single seller (monopoly) and a single buyer (monopsony).

Q28: Turner,a successful executive,is negotiating a compensation

Q37: None of the prepaid rent paid on

Q38: Antiques may be eligible for cost recovery

Q71: Gary,who is an employee of Red Corporation,has

Q81: During 2012,Eva used her car as follows:

Q85: Derek,age 46,is a surviving spouse.If he has

Q86: In 2012,Pierre had the following transactions: <img

Q87: Nick Lee is a linebacker for the

Q113: A U.S.citizen worked in a foreign country

Q126: In terms of the tax formula applicable