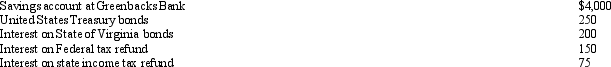

Doug and Pattie received the following interest income in the current year:  Greenbacks Bank also gave Doug and Pattie a cellular phone (worth $100) for opening the savings account.What amount of interest income should they report on their joint income tax return?

Greenbacks Bank also gave Doug and Pattie a cellular phone (worth $100) for opening the savings account.What amount of interest income should they report on their joint income tax return?

Definitions:

Q14: Roger,an individual,owns a proprietorship called Green Thing.For

Q19: Tan Company acquires a new machine (ten-year

Q20: The amortization period in 2012 for $4,000

Q48: If a new car that is used

Q56: The additional standard deduction for age and

Q70: Meg,age 23,is a full-time law student and

Q77: Susan has the following items for 2012:<br>·

Q85: Derek,age 46,is a surviving spouse.If he has

Q113: Hans purchased a new passenger automobile on

Q114: Orange Corporation begins business on April 2,2012.The