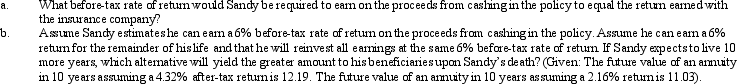

Sandy is married,files a joint return,and expects to be in the 28% marginal tax bracket for the foreseeable future.All of his income is from salary and all of it is used to maintain the household.He has a paid-up life insurance policy with a cash surrender value of $100,000.He paid $60,000 of premiums on the policy.His gain from cashing in the life insurance policy would be ordinary income.If he retains the policy,the insurance company will pay him $3,000 (3%)interest each year.Sandy thinks he can earn a higher return if he cashes in the policy and invests the proceeds.

Definitions:

Experiments

Structured investigations designed to test hypotheses and observe the effects of manipulating one or more variables in a controlled setting.

Recording Observations

The systematic documentation of events, behaviors, or conditions as they are perceived, without adding interpretation or inference.

Four Ds

Criteria in psychology that describe abnormal behavior: Deviance, Distress, Dysfunction, and Danger.

Vague And Subjective

Describes statements or concepts that are unclear, poorly defined, and open to wide interpretation based on personal opinions or feelings rather than concrete facts.

Q47: Ron,age 19,is a full-time graduate student at

Q57: Juanita,single and age 43,had the following items

Q63: Which of the following is relevant in

Q85: If the employer provides all employees with

Q88: Because graduate teaching assistantships are awarded on

Q122: Olive,Inc.,an accrual method taxpayer,is a corporation that

Q123: Because they appear on page 1 of

Q142: Generally,a closely-held family corporation is not permitted

Q146: In determining a partner's basis in the

Q151: Because it has only one owner,any sole