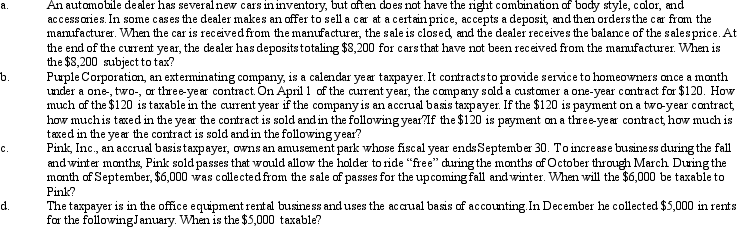

Determine the proper tax year for gross income inclusion in each of the following cases.

Definitions:

Sales and Sales Taxes

Revenue from goods or services sold, and the tax collected on these sales, which is remitted to the government.

Gross Earnings

The total income earned by a business before deductions such as taxes, expenses, and costs.

Net Pay

The take-home pay an employee receives after deductions such as taxes and retirement contributions.

Federal Income Tax

The annual income of individuals, corporations, trusts, and other legal entities is subject to a tax imposed by the IRS.

Q18: Which tax source may override a Regulation

Q34: Under the terms of a divorce agreement,Ron

Q44: Regarding the tax treatment of charitable contributions,corporations

Q56: Paula transfers stock to her former spouse,Fred.The

Q69: Sally and Ed each own property with

Q101: Discuss the application of the "one-year rule"

Q102: Heather is a full-time employee of the

Q109: If an item such as property taxes

Q110: A theft of investment property can create

Q134: Azure Corporation,a calendar year taxpayer,has taxable income