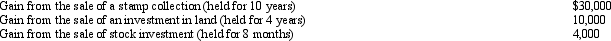

Perry is in the 33% tax bracket.During 2012,he had the following capital asset transactions:  Perry's tax consequences from these gains are as follows:

Perry's tax consequences from these gains are as follows:

Definitions:

Perfect Competition

A market structure characterized by a large number of small firms competing against each other, where no single firm has the market power to influence the price of the product it sells.

Economic Profit

The difference between total revenue and total costs, including both explicit and implicit costs, indicating the efficiency of resource utilization beyond just financial gain.

Marginal Costs

The cost of producing a subsequent unit of a product or service.

Long Run

The long run is a period in economics where all inputs or factors of production can be varied, allowing firms to adjust fully to market conditions.

Q12: The IRS is required to make a

Q21: Ed is divorced and maintains a home

Q35: Which is not considered to be a

Q40: Sarah furnishes more than 50% of the

Q49: A taxpayer must pay any tax deficiency

Q68: Before a tax bill can become law,it

Q71: Which of the following rules are the

Q76: Which of the following is not published

Q117: The B & W partnership earned taxable

Q145: Regarding the rules applicable to filing of