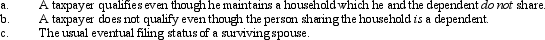

Regarding head of household filing status,comment on the following:

Definitions:

AGI Phaseout Rules

Guidelines that gradually reduce or eliminate certain deductions and credits as adjusted gross income (AGI) reaches specified levels.

Qualified Pension Plan

A retirement plan conforming to IRS requirements, offering tax advantages and benefits to employees.

Deducted Immediately

Expenses that can be subtracted from gross income in the year they are incurred, without capitalization or amortization.

Employer-sponsored Retirement Plan

An employer-sponsored retirement plan is a savings plan set up by employers to help employees prepare for retirement, with common types being 401(k) and 403(b) plans.

Q21: Ben was hospitalized for back problems.While he

Q23: An increase in a taxpayer's AGI will

Q26: For tax purposes,married persons filing separate returns

Q34: As an executive of Cherry,Inc.,Ollie receives a

Q43: Danielle,who is retired,reaches age 70 1/2 in

Q46: Part II of Form 4797 is used

Q54: Under the terms of a divorce agreement,Kim

Q84: The taxpayer is an appliance dealer and

Q89: Mike contracted with Kram Company,Mike's controlled corporation.Mike

Q101: The minimum annual distributions must be made