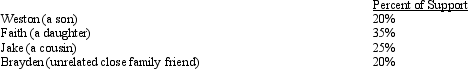

Millie,age 80,is supported during the current year as follows:  During the year,Millie lives in an assisted living facility.Under a multiple support agreement,indicate which parties can qualify to claim Millie as a dependent.

During the year,Millie lives in an assisted living facility.Under a multiple support agreement,indicate which parties can qualify to claim Millie as a dependent.

Definitions:

Subsidiary's Adjusted Income

The net income of a subsidiary company after making adjustments for fair value measurements, currency translation, and other accounting policies.

Dividends

Payments made by a corporation to its shareholder members, distributing a portion of the company's earnings.

Notes Payable

A written promise to pay a specified sum of money, usually with interest, by a certain date, classified as a liability on the balance sheet.

Gross Margin

The difference between revenue and cost of goods sold, expressed as a percentage of revenue, indicating the financial health of a company’s sales.

Q9: Alfred's Enterprises,an unincorporated entity,pays employee salaries of

Q21: Forfeitures may be allocated to the accounts

Q21: Ed is divorced and maintains a home

Q23: Depending on the nature of the expenditure,expenses

Q46: Early in the year,Marion was in an

Q51: A taxpayer who claims the standard deduction

Q60: In the case of an accrual basis

Q82: Graham,a CPA,has submitted a proposal to do

Q82: Under the check-the-box Regulations,a multi-owner entity that

Q163: Like regular dividends,constructive dividends must be distributed