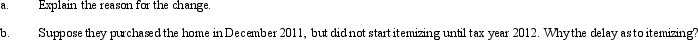

When filing their Federal income tax returns,the Youngs always claimed the standard deduction.After they purchased a home,however,they started to itemize their deductions from AGI.

Definitions:

Machine-hour

A metric that quantifies the number of hours a machine is utilized to manufacture products during a specified timeframe.

High-low Method

An approach in managerial accounting that approximates variable and fixed costs by examining the maximum and minimum levels of activity.

Inspection Costs

Expenses associated with the activity of checking and verifying the quality or specifications of goods or services.

Direct Labor-hour

A measure of the amount of time spent by workers directly involved in the production process to manufacture a product.

Q13: In § 212(1),the number (1)stands for the:<br>A)

Q28: Barbara was injured in an automobile accident.She

Q65: José,a cash method taxpayer,is a partner in

Q76: Our tax laws encourage taxpayers to _

Q76: Married taxpayers who file separately cannot later

Q83: In the case of a sale reported

Q100: Terry,Inc.,makes gasoline storage tanks.All production is done

Q103: Nelda is married to Chad,who abandoned her

Q115: Bob and April own a house at

Q148: All exclusions from gross income are reported