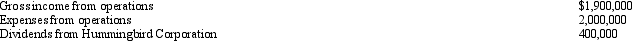

In the current year,Mockingbird Corporation (a calendar year taxpayer) has the following income and expenses:  Mockingbird Corporation owns 10% of the stock of Hummingbird Corporation.The dividends received deduction for the current year is:

Mockingbird Corporation owns 10% of the stock of Hummingbird Corporation.The dividends received deduction for the current year is:

Definitions:

Operative Site

The specific area of the body on which surgery is performed.

Neuromuscular Structures

Anatomical components, such as muscles and nerves, that work together to generate movement and transmit signals between the brain and the body.

Surgical Environment

A sterile, controlled space where surgical procedures are performed, designed to minimize the risk of infection and ensure patient safety.

Operative Suite

A specialized facility within a hospital where surgical procedures are carried out, typically including operating rooms, pre- and post-anesthesia care units, and support staff areas.

Q14: Tom has owned 40 shares of Orange

Q31: Technical Advice Memoranda may not be cited

Q33: A taxpayer can obtain a jury trial

Q37: Blue Mart operates a large chain of

Q45: During the year,Irv had the following transactions:<br>

Q62: Lois,who is single,received $9,000 of Social Security

Q75: The Internal Revenue Code was first codified

Q89: Amber Machinery Company purchased a building from

Q123: The Purple & Gold Gym,Inc.,uses the accrual

Q124: Under the terms of a divorce agreement,Lanny