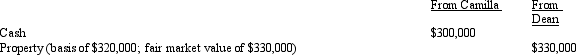

Camilla and Dean form Grouse Corporation with the following investment:  Camilla and Dean each receive 300 shares of stock in Grouse Corporation and,in addition,Dean receives $30,000 in cash.As a result of the transfer,Dean's basis in the stock and Grouse's basis in the property will be:

Camilla and Dean each receive 300 shares of stock in Grouse Corporation and,in addition,Dean receives $30,000 in cash.As a result of the transfer,Dean's basis in the stock and Grouse's basis in the property will be:

Definitions:

Outstanding Balance

Outstanding balance refers to the amount of money that is still owed on a loan or credit account at any given time.

Invoice

A document issued by a seller to a buyer that lists goods or services provided and the due payment.

Payment

The act of giving money or other compensation to settle a transaction.

Terms

Conditions and stipulations that define an agreement or contract.

Q17: Warren,age 17,is claimed as a dependent by

Q34: The Martins have a teenage son who

Q39: If there is a net § 1231

Q45: In 2012,Todd purchased an annuity for $200,000.The

Q62: Section 1245 may apply to depreciable farm

Q64: Which of the following is not an

Q66: What causes a partner's basis in a

Q80: Wendy sold property on the installment basis

Q91: Snipe Corporation,a calendar year taxpayer,has total E

Q104: The amount of Social Security benefits received