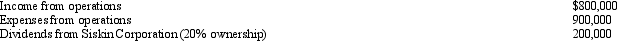

Skinner Corporation,a calendar year C corporation,had the following transactions during the current year:  Skinner's taxable income (or NOL) for the current year is:

Skinner's taxable income (or NOL) for the current year is:

Definitions:

Internal Control Environment

The overall attitude, awareness, and actions of directors, management, and personnel regarding internal controls and their importance in the organization.

Monitoring Policies

Procedures and guidelines established by an organization to systematically observe and assess the effectiveness of its policies and procedures.

Internal Control

Processes and procedures implemented by a business to safeguard its assets, ensure accurate and reliable financial reporting, promote efficiency, and ensure compliance with laws and regulations.

Assets Safeguarded

Measures or controls implemented to protect a company’s assets from theft, damage, or misuse.

Q26: For tax purposes,married persons filing separate returns

Q47: Maroon Corporation expects the employees' income tax

Q55: The DEF Partnership had three equal partners

Q63: Qualified dividends received by a noncorporate shareholder

Q64: Which of the following creates potential §

Q72: Explain the tax appeals process from trial

Q76: Like S corporations,partnerships serve as conduits for

Q79: In forming a corporation in 2012,organizational expenditures

Q98: As of January 1,2012,Amanda,the sole shareholder of

Q99: For purposes of determining the partnership's tax