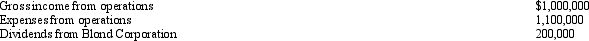

In the current year,Auburn Corporation (a calendar year taxpayer) ,has the following income and expenses:  Auburn Corporation owns 20% of the stock in Blond Corporation.The dividends received deduction for the current year is:

Auburn Corporation owns 20% of the stock in Blond Corporation.The dividends received deduction for the current year is:

Definitions:

Northern Democrats

A political faction in the United States before the Civil War, consisting of Democrats from the Northern states who had a range of views on slavery.

Ex-Confederate States

Refers to the Southern states that seceded from the United States to form the Confederacy during the American Civil War and were later readmitted to the Union.

Paternalism

A policy or practice of treating or governing people in a fatherly manner, especially by providing for their needs without giving them rights or responsibilities.

13th Amendment

Amendment to the United States Constitution, ratified in 1865, which abolished slavery and involuntary servitude, except as punishment for a crime.

Q6: Copper Corporation sold machinery for $27,000 on

Q10: Peggy is an executive for the Tan

Q28: In 2012,Norma sold Zinc,Inc.,common stock for $100,000

Q31: Guaranteed payments have no effect on the

Q32: Under the original issue discount (OID)rules as

Q42: The Royal Motor Company manufactures automobiles.Employees of

Q49: A taxpayer must pay any tax deficiency

Q67: Three judges will normally hear each U.S.Tax

Q72: Explain the tax appeals process from trial

Q76: Scott,age 68,has accumulated $850,000 in a defined