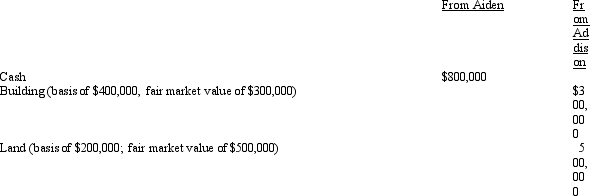

Aiden and Addison form Dove Corporation with the following investments:  Dove issues stock equally to Aiden and Addison.One of the tax consequences of these transfers is:

Dove issues stock equally to Aiden and Addison.One of the tax consequences of these transfers is:

Definitions:

Intuitive

Having the ability to understand or know something immediately based on feelings rather than facts.

Assertive

Having or showing a confident and forceful personality, enabling clear and direct communication.

Creative Problem Solvers

Individuals who excel in generating novel and effective solutions to complex issues by thinking outside the conventional parameters.

Introvert

A person who tends to like time alone, solitude, and reflection and prefers the world of ideas and thoughts.

Q10: The maximum annual contribution to a Roth

Q16: A scholarship recipient at State University may

Q20: The effects of a below-market loan for

Q54: The chart below describes the § 1231

Q63: Mr.Lee is a citizen and resident of

Q63: Gold Corporation,Silver Corporation,and Copper Corporation are equal

Q65: The domestic production activities deduction (DPAD)is handled

Q69: The taxpayer had incorrectly been using the

Q93: Cash received by an individual:<br>A) Is not

Q107: Generally,a U.S.citizen is required to include in