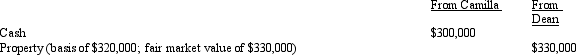

Camilla and Dean form Grouse Corporation with the following investment:  Camilla and Dean each receive 300 shares of stock in Grouse Corporation and,in addition,Dean receives $30,000 in cash.As a result of the transfer,Dean's basis in the stock and Grouse's basis in the property will be:

Camilla and Dean each receive 300 shares of stock in Grouse Corporation and,in addition,Dean receives $30,000 in cash.As a result of the transfer,Dean's basis in the stock and Grouse's basis in the property will be:

Definitions:

Chlamydia

A common sexually transmitted infection caused by the bacterium Chlamydia trachomatis, often asymptomatic but treatable with antibiotics.

Huntington's

A hereditary disease that results in the death of brain cells, leading to cognitive decline, psychiatric issues, and physical movement problems, with symptoms typically appearing between 30 to 50 years of age.

PID

Pelvic Inflammatory Disease, an infection of the female reproductive organs usually caused by sexually transmitted bacteria.

HIV

Human Immunodeficiency Virus, a retrovirus that attacks the immune system, leading to weakened defense against diseases and, potentially, the development of AIDS.

Q1: On June 1,2012,Brady purchased an option to

Q2: Federal tax legislation generally originates in the

Q8: Vertical,Inc.,has a 2012 net § 1231 gain

Q47: Contributions to a qualified pension plan are

Q60: Regarding head of household filing status,comment on

Q85: George,an unmarried cash basis taxpayer,received the following

Q85: Unlike individuals,corporations cannot take advantage of §

Q94: Stuart owns 300 shares of Turquoise Corporation

Q98: A qualified plan must provide,at a minimum,that

Q106: If a tax-exempt bond will yield approximately