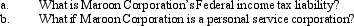

In the current year,Maroon Corporation,a calendar year corporation,has taxable income from operations of $90,000 and a long-term capital gain of $5,000.

Definitions:

Computerized Surveying

The use of digital techniques and tools to conduct surveys, often leading to more efficient data collection and analysis.

Hewlett-Packard

A global technology company known for its wide range of hardware, software, and services to consumers, small- and medium-sized businesses, and large enterprises.

Survey Research

A method of collecting data from a predefined group of respondents to gain information about behaviors, thoughts, or opinions.

IBM

International Business Machines Corporation, a multinational technology and consulting company known for its computers, software, and IT services.

Q4: The subdivision of real property into lots

Q15: Karen,an accrual basis taxpayer,sold goods in December

Q49: Emerald Corporation and Gold Corporation each own

Q59: Ted was shopping for a new automobile.He

Q70: The taxpayer's marginal tax bracket is 25%.Which

Q71: Which of the following rules are the

Q74: Business equipment is purchased on March 10,2011,used

Q78: Ted earned $150,000 during the current year.He

Q111: Tonya is a cash basis taxpayer.In 2012,she

Q112: The nonrecognition of gains and losses under