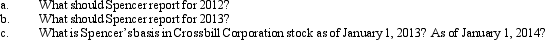

Spencer owns 50% of the stock of Crossbill Corporation,a calendar year taxpayer that has elected Subchapter S status.As of January 1,2012,Spencer's basis in the stock is $40,000.Crossbill has an operating loss of $100,000 for 2012 and taxable income of $60,000 for 2013.

Definitions:

Library

A collection of books, media, and other informational resources accessible to the public or a specific community for reading, study, and reference.

Insecure Attachment Style

A pattern of attachment characterized by anxiety or avoidance in close relationships, stemming from childhood experiences.

Ainsworth, Blehar, Waters, Wall

Researchers known for their work on attachment theory, particularly the development of the Strange Situation procedure to assess infant attachment styles.

Attachment Styles

Patterns of expectations, needs, and emotions one displays in interpersonal relationships, developed in early childhood.

Q5: The Internal Revenue Code of 1986 was

Q6: The LIFO method is beneficial only when

Q6: If a taxpayer exchanges like-kind property under

Q28: Which of the following statements,if any,is characteristic

Q32: In completing a Schedule M-1 of Form

Q55: Christie sued her former employer for a

Q62: Lease cancellation payments received by a lessor

Q81: A retirement plan covers 72% of the

Q103: Darlene,a 30% shareholder in a calendar year

Q119: In December 2012,Oriole Company's board authorizes a