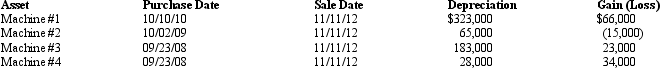

A business taxpayer sold all the depreciable assets of the business,calculated the gains and losses,and would like to know the final character of those gains and losses.The taxpayer had $353,000 of adjusted gross income before considering the gains and losses from sale of the business assets.The taxpayer had unrecaptured § 1231 lookback loss of $22,000.What is the treatment of the gains and losses summarized in the chart below after all possible netting and reclassification has been completed? What is the taxpayer's adjusted gross income? (Ignore the self-employment tax deduction.)

Definitions:

Process Agreement

An understanding or accord between social worker and client regarding the methods, goals, and expectations of the social work intervention.

Person Acclimated

An individual who has become accustomed or adapted to a new environment, situation, or set of conditions.

Vocal Member

An individual within a group who is more outspoken or active in expressing opinions and influencing group dynamics.

Averaging

The mathematical process of finding the central or typical value of a set of numbers by dividing the sum of all values by the number of values.

Q14: Casualty gains and losses from nonpersonal use

Q62: The incremental research activities credit is 20%

Q67: Matt,who is single,sells his principal residence,which he

Q72: Jesse purchases land and an office building

Q75: Juan refuses to give the bank where

Q76: Which of the following is not published

Q77: The maximum amount of the § 121

Q88: Pursuant to a complete liquidation,a corporation sells

Q98: Milton owns a bond (face value of

Q135: On February 2,2012,Karin purchases real estate for