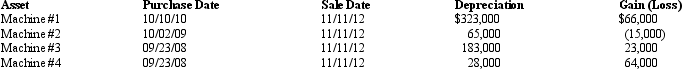

A business taxpayer sold all the depreciable assets of the business,calculated the gains and losses,and would like to know the final character of those gains and losses.The taxpayer had $353,000 of adjusted gross income before considering the gains and losses from sale of the business assets.The taxpayer had unrecaptured § 1231 lookback loss of $12,000.What is the treatment of the gains and losses summarized in the chart below after all possible netting and reclassification has been completed? What is the taxpayer's adjusted gross income? (Ignore the self-employment tax deduction.)

Definitions:

Love Withdrawal

A behavioral control technique used by caregivers, where affection or attention is withheld to influence or punish certain behaviors in children.

Induction

A reasoning method that makes generalizations based on observations, moving from specific instances to broader generalizations.

Scheffé Test

A statistical post-hoc test used to compare multiple group means simultaneously after an ANOVA to control the type I error rate.

Tukey Test

Statistical procedure used to control familywise error when conducting all possible simple comparisons between groups.

Q2: Charmine,a single taxpayer with no dependents,has already

Q7: Technical Advice Memoranda deal with completed transactions.

Q11: Orange Company had machinery destroyed by a

Q27: Lucinda,a calendar year taxpayer,owned a rental property

Q38: The accrual basis taxpayer sold land for

Q45: Which would not be considered an advantage

Q65: Which of the following characteristics describes a

Q85: The tax credit for rehabilitation expenditures for

Q101: Section 1033 (nonrecognition of gain from an

Q141: The Schedule M-1 to Form 1120 starts