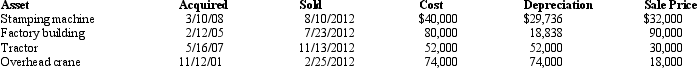

The chart below describes the § 1231 assets sold by the Ecru Company (a sole proprietorship)this year.Compute the gain or loss from each asset disposition and determine the net § 1231 gain treated as long-term capital gain for the year.Assume there is a § 1231 lookback loss of $4,000.

Definitions:

Inflammatory Disease

A disease characterized by inflammation, which is the body's response to infection or injury, leading to redness, swelling, and pain.

Wheezing

A high-pitched whistling sound made while breathing, often indicating breathing difficulties or obstructed airways.

Dyspnea

Difficulty in breathing, often described as an uncomfortable feeling of breathlessness.

Orthopnea

Difficulty breathing when lying down flat; a symptom often associated with heart failure or lung disease, alleviated by sitting or standing up.

Q19: Alicia buys a beach house for $425,000

Q24: From an employee's point of view,discuss the

Q24: In 2012 Angela,a single taxpayer with no

Q26: A taxpayer who meets the age requirement

Q56: Brett owns investment land located in Tucson,Arizona.He

Q61: If a taxpayer chooses to claim a

Q62: Lease cancellation payments received by a lessor

Q71: The holding period of replacement property where

Q77: Yvonne exercises incentive stock options (ISOs)for 100

Q97: Gene purchased an SUV for $42,000 which