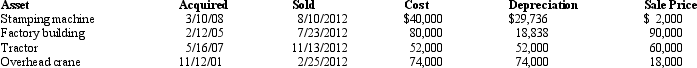

The chart below describes the § 1231 assets sold by the Tan Company (a sole proprietorship)this year.Compute the gain or loss from each asset disposition and determine the net § 1231 gain treated as long-term capital gain for the year.Assume there is a § 1231 lookback loss of $14,000.

Definitions:

Cost of Capital

The minimum earnings rate required by a company on its investment endeavors to maintain market valuation and attract funding.

Budgetary Limit

The maximum amount of money allocated for a specific purpose in a budget.

IRRs

The Internal Rate of Return is the discount rate at which the net present value of all cash flows from a specific project is zero.

NPV

Net Present Value, a calculation used to determine the present value of a series of future cash flows by discounting them at a specific rate.

Q12: To qualify as a like-kind exchange,real property

Q13: In § 212(1),the number (1)stands for the:<br>A)

Q22: Snow Corporation began business on May 1,2012,and

Q70: The bank forecloses on Lisa's apartment complex.The

Q83: If a taxpayer is required to recapture

Q87: Nigel purchased a blending machine for $125,000

Q88: Beth,age 51,has a traditional deductible IRA with

Q113: Jena owns land as an investor.She exchanges

Q142: Karen owns City of Richmond bonds with

Q151: On January 15 of the current taxable