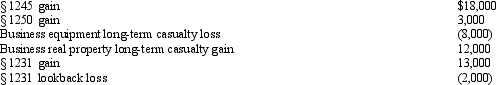

Betty,a single taxpayer with no dependents,has the gains and losses shown below.Before considering these transactions,Betty has $45,000 of other taxable income.What is the treatment of the gains and losses and what is Betty's taxable income?

Definitions:

Pushcart

A small cart on wheels, often used by vendors to sell goods in public areas.

Output

The volume of output in terms of products or services from a corporation, industry, or the economic structure.

Pink Flamingo

A type of decoration often used in gardens and lawns, characterized by its bright pink color and flamingo shape.

Artisans

Skilled craft workers who make or create items by hand that may be functional or strictly decorative, such as furniture, clothing, jewelry, and household items.

Q8: Gains and losses on nontaxable exchanges are

Q11: The accrual method generally is required to

Q24: In 2012 Angela,a single taxpayer with no

Q52: The maximum child tax credit under current

Q55: Child and dependent care expenses do not

Q62: Albert is in the 35% marginal tax

Q99: Which,if any,of the following rules relate only

Q104: The taxpayer does need the IRS's permission

Q134: Azure Corporation,a calendar year taxpayer,has taxable income

Q154: The basis of property received by gift