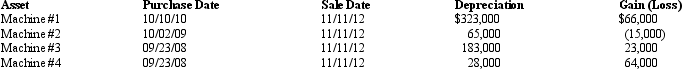

A business taxpayer sold all the depreciable assets of the business,calculated the gains and losses,and would like to know the final character of those gains and losses.The taxpayer had $353,000 of adjusted gross income before considering the gains and losses from sale of the business assets.The taxpayer had unrecaptured § 1231 lookback loss of $12,000.What is the treatment of the gains and losses summarized in the chart below after all possible netting and reclassification has been completed? What is the taxpayer's adjusted gross income? (Ignore the self-employment tax deduction.)

Definitions:

Self-Construals

The ways individuals perceive, comprehend, and interpret themselves, influenced by cultural and social contexts.

Self-Esteem

Someone's subjective appraisal of their own value or worth.

Favorite Food

An individual's most preferred food item or dish, which brings a high level of enjoyment and satisfaction.

Depressed People

Individuals who are experiencing a persistent feeling of sadness or loss of interest, which can affect their daily functioning.

Q1: On June 1,2012,Brady purchased an option to

Q20: Which of the following must use the

Q21: In 2012,Cashmere Construction Company enters into a

Q29: Several years ago,Tom purchased a structure for

Q39: If there is a net § 1231

Q66: What causes a partner's basis in a

Q69: Nonrecaptured § 1231 losses from the seven

Q88: Pursuant to a complete liquidation,a corporation sells

Q122: The amount received for a utility easement

Q123: If losses are disallowed in a related