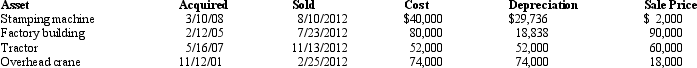

The chart below describes the § 1231 assets sold by the Tan Company (a sole proprietorship)this year.Compute the gain or loss from each asset disposition and determine the net § 1231 gain treated as long-term capital gain for the year.Assume there is a § 1231 lookback loss of $14,000.

Definitions:

Participant Observation

A research method in sociology and anthropology in which the researcher immerses themselves in the community being studied to observe behaviors and interactions firsthand.

Quantitative Studies

Research methods focused on the collection and analysis of numerical data to understand patterns, relationships, or trends.

Structured Interviews

A method of data collection in research where the interviewer asks a set of predetermined questions with the aim of ensuring consistency across interviews.

Informed Consent

Agreement or permission granted with full knowledge of the possible risks and benefits, typically in a medical or experimental context.

Q1: Corporate taxpayers lose the benefits of lower

Q9: An incentive stock option (ISO)plan is considered

Q27: Lucinda,a calendar year taxpayer,owned a rental property

Q49: A taxpayer must pay any tax deficiency

Q53: Individuals who are not professional real estate

Q54: If a C corporation has taxable income

Q87: Qualifying tuition expenses paid from the proceeds

Q89: Maud exchanges a rental house at the

Q125: Don,who is single,sells his personal residence on

Q143: Identify two tax planning techniques that can