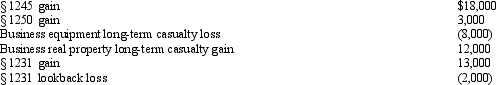

Betty,a single taxpayer with no dependents,has the gains and losses shown below.Before considering these transactions,Betty has $45,000 of other taxable income.What is the treatment of the gains and losses and what is Betty's taxable income?

Definitions:

Extinction

In psychology, the gradual weakening and eventual disappearance of a conditioned response.

Spontaneous Recovery

The reappearance of a previously extinguished response after a period of non-exposure to the conditioned stimulus.

Extinction

In psychology, the gradual weakening and eventual disappearance of a conditioned response when the conditioned stimulus is no longer paired with the unconditioned stimulus.

Spontaneous Recovery

The reappearance of a previously extinguished conditioned response after a period of time without exposure to the conditioned stimulus.

Q22: Phil's father died on January 10,2012.The father

Q35: Which is not considered to be a

Q47: An eligible taxpayer may elect to receive

Q52: What is a Technical Advice Memorandum?

Q54: Which of the following cannot be found

Q83: During 2012,Howard and Mabel,a married couple,decided to

Q86: Which of the following,if any,correctly characterize the

Q91: The use of the LIFO inventory method

Q136: The holding period of property acquired by

Q142: Currently all C corporations must file a