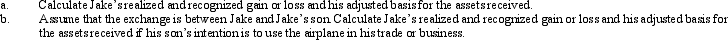

Jake exchanges an airplane used in his business for a smaller airplane to be used in his business.His adjusted basis for the airplane is $325,000 and the fair market value is $310,000.The fair market value of the smaller airplane is $300,000.In addition,Jake receives cash of $10,000.

Definitions:

Soviet Union

A socialist state that existed from 1922 to 1991 in Eurasia, officially known as the Union of Soviet Socialist Republics (USSR), which was a federal union of multiple national republics.

Social and Economic Rights

Rights that aim to guarantee individuals access to basic social and economic necessities, including healthcare, education, and adequate living standards.

Operation Dixie

CIO’s largely ineffective post–World War II campaign to unionize southern workers.

Unionize

The process by which workers come together to form a union, a collective organization that represents their interests in negotiations with employers over wages, working conditions, and other employment terms.

Q1: Ramon sold land in 2012 with a

Q19: Explain the purpose of the disabled access

Q20: Which of the following must use the

Q35: The Yellow Equipment Company,an accrual basis C

Q53: Robin Construction Company began a long-term contract

Q60: Which court decisions are published in paper

Q61: Which of the following events causes the

Q66: Gail exchanges passive Activity A,which has suspended

Q67: The amount of the loss basis of

Q115: Emma gives 1,000 shares of Green,Inc.stock to