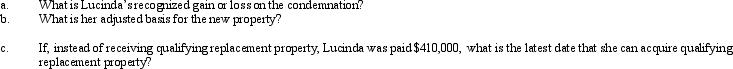

Lucinda,a calendar year taxpayer,owned a rental property with an adjusted basis of $312,000 in a major coastal city.Her property was condemned by the city government on October 12,2012.In order to build a convention center,Lucinda eventually received qualified replacement property from the city government on March 9,2013.This new property has a fair market value of $410,000.

Definitions:

Clinicians

Professional healthcare providers who work directly with patients, diagnosing and treating illnesses, diseases, and injuries.

Foucha V. Louisiana

A landmark U.S. Supreme Court case that ruled it unconstitutional to indefinitely confine someone in a psychiatric hospital if they were not mentally ill and did not present a danger to themselves or others.

Hospitalized Offenders

Individuals who have committed crimes and are undergoing treatment in a hospital setting, typically due to mental health issues or substance abuse.

Supreme Court

The highest federal court in the United States, which has the ultimate judicial authority to interpret and decide upon the constitutionality of laws.

Q19: Harry inherited a residence from his mother

Q28: The maximum amount of the unrecaptured §

Q36: A participant who is at least age

Q36: Tad is a vice-president of Ruby Corporation.In

Q50: A taxpayer may qualify for the credit

Q55: A business taxpayer sells depreciable business property

Q63: Some (or all)of the tax credit for

Q65: Personal use property casualty gains and losses

Q70: Distributions from a Roth IRA that are

Q79: Miriam,who is a head of household and