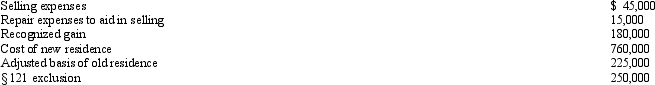

Use the following data to determine the sales price of Etta's principal residence and the realized gain.She is not married.The sale of the old residence qualifies for the § 121 exclusion.

Definitions:

Credit Availability

The ease with which individuals or businesses can obtain loans or credit.

Cash Discounts

The amount by which a seller is willing to reduce the invoice price in order to be paid immediately, rather than in the future. A cash discount might be 2/10, net 30, which means a 2% discount if the bill is paid within 10 days, otherwise the entire amount is due within 30 days.

Delayed Payment

Delayed Payment is a payment made after the originally agreed-upon due date, often subject to additional fees or interest charges.

Credit Policy

Guidelines that a company follows to determine the creditworthiness of customers, the terms of credit to offer, and how to collect payments.

Q8: Harry and Wilma are married and file

Q15: The calculation of FICA and the self-employment

Q22: Harry earned investment income of $18,500,incurred investment

Q40: Susan,an executive,receives a golden parachute payment of

Q41: The tax law requires that capital gains

Q46: Cason is filing as single and has

Q60: Lynne owns depreciable residential rental real estate

Q79: Betty owns a horse farm with 500

Q91: The use of the LIFO inventory method

Q100: Cassie purchases a sole proprietorship for $145,000.The