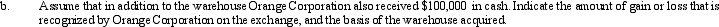

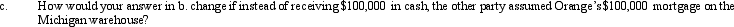

a.Orange Corporation exchanges a warehouse located in Michigan (adjusted basis of $560,000)for a warehouse located in Ohio (adjusted basis of $450,000; fair market value of $525,000).Indicate the amount of gain or loss that is recognized by Orange Corporation on the exchange,and the basis of the warehouse acquired.

Definitions:

Capital Gains

Capital gains are the profit earned from the sale of an asset, such as stocks, bonds, or real estate, which exceeds the purchase price.

Tax Tables

Charts or tables provided by tax authorities that show the amount of tax payable based on income earned, used to calculate tax liabilities.

Shareholders' Wealth

The total value of a company's shares, reflecting the overall financial well-being and investment attractiveness of the company to its shareholders.

Weighted Average Cost of Capital (WACC)

A calculation of a company's cost of capital where each category of capital is proportionally weighted, including equity, debt, and other forms of financing.

Q2: Ramon is in the business of buying

Q23: In 2012,Arnold invests $80,000 for a 20%

Q28: In 2012,Norma sold Zinc,Inc.,common stock for $100,000

Q45: A realized gain on an indirect (conversion

Q52: Dana contributes $2,000 too much to a

Q60: The basis of personal use property converted

Q67: Taylor sold a capital asset on the

Q71: Kim dies owning a passive activity with

Q81: Tax bills are handled by which committee

Q86: Ivory Fast Delivery Company,an accrual basis taxpayer,frequently