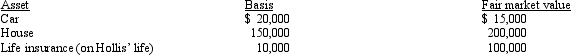

Henrietta and Hollis have been married for 10 years when Hollis dies in a sky-diving accident.Their assets are summarized below.  Henrietta and Hollis reside in Wisconsin,a community property state.All of the assets were acquired with community funds and pass to Henrietta.Her basis for each of the assets becomes:

Henrietta and Hollis reside in Wisconsin,a community property state.All of the assets were acquired with community funds and pass to Henrietta.Her basis for each of the assets becomes:

Car House Cash from life insurance proceeds

Definitions:

Active Response

Engaging directly and promptly with communication or stimuli, suggesting a dynamic and participatory approach.

Active Listening

The practice of fully concentrating on what is being said, understanding the message, responding appropriately, and remembering the conversation.

Mirroring

The act of imitating or replicating another person's behavior, gesture, or speech.

Feeding Back

Providing evaluative or corrective information about an action, event, or process to the original source.

Q26: How does the replacement time period differ

Q56: Section 1231 lookback losses may convert some

Q56: Brett owns investment land located in Tucson,Arizona.He

Q57: Several years ago,Sarah purchased a structure for

Q70: Wallace owns a construction company that builds

Q89: Vic's at-risk amount in a passive activity

Q91: The use of the LIFO inventory method

Q99: For purposes of determining the partnership's tax

Q106: If an installment sale contract does not

Q108: The taxpayer can elect to have the