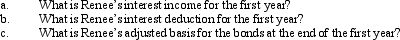

Renee purchases taxable bonds with a face value of $200,000 for $212,000.The annual interest paid on the bonds is $10,000.Assume Renee elects to amortize the bond premium.The total premium amortization for the first year is $1,600.

Definitions:

Negotiation

The process by which the buyer and the seller reach a mutually satisfactory agreement.

Forestall

To prevent, hinder, or obstruct an event, action, or outcome by taking advanced or anticipatory measures.

Objections

Concerns, hesitations, or reasons a potential customer has for not making a purchase, which a salesperson aims to overcome through objection handling techniques.

Setting A Condition

Establishing a specific requirement or criteria that must be met in a given situation or agreement.

Q11: Nora acquired passive activity A several years

Q50: Which of the following statements regarding the

Q70: Wallace owns a construction company that builds

Q72: Jesse purchases land and an office building

Q87: Which of the following can produce an

Q91: Mike's basis in his stock in Tan

Q94: Jack owns a 10% interest in a

Q99: Under what circumstance is there recognition of

Q102: In 2012,Shirley sold her personal residence to

Q107: Which of the following statements is incorrect?<br>A)