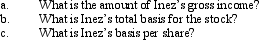

Inez's adjusted basis for 9,000 shares of Cardinal,Inc.common stock is $900,000.During the year,she receives a 5% stock dividend that is a nontaxable stock dividend.

Definitions:

Fundamental Theology

involves studying the fundamental beliefs and concepts of religion to understand its basis, nature, and justification.

Denominations

In religion, distinct groups or branches within a larger religious framework that share common beliefs and practices but are organizationally independent.

Religious Text

Writings considered sacred and central to the beliefs, practices, and traditions of a religious community.

Phases Of Conversion

The stages an individual goes through when changing or adopting new beliefs, often used in the context of religious or ideological change.

Q7: Green Corporation earns active income of $50,000

Q8: In applying the lower of cost or

Q31: The installment method applies where a payment

Q42: David earned investment income of $20,000,incurred investment

Q45: In 2012,Sean incurs $90,000 of mining exploration

Q81: For a taxpayer who is required to

Q83: During 2012,Howard and Mabel,a married couple,decided to

Q107: In describing FICA taxes,which (if any)of the

Q131: Ed and Cheryl have been married for

Q135: Latisha owns a warehouse with an adjusted