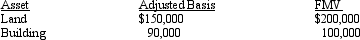

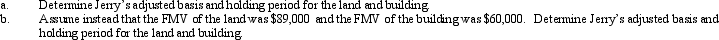

On September 18,2012,Jerry received land and a building from Ted as a gift.Ted had purchased the land and building on March 5,2009,and his adjusted basis and the fair market value at the date of the gift were as follows:

Ted paid gift tax on the transfer to Jerry of $96,000.

Ted paid gift tax on the transfer to Jerry of $96,000.

Definitions:

Division of Labor

The allocation of different parts of a manufacturing process or task to different people in order to improve efficiency.

Printed Book

A physical book that is made by printing text and images on paper and binding them together.

Content Creation

The process of generating topic ideas that appeal to one's target audience, creating written or visual content around those ideas, and making that information accessible to the audience as a blog, video, infographic, or other formats.

Electronic Communications

Transmission of information using electronic systems or devices, including email, social media, and texting.

Q3: Judy owns a 20% interest in a

Q43: Laura purchased for $1,610 a $2,000 bond

Q50: A taxpayer may qualify for the credit

Q53: Discuss the treatment of losses from involuntary

Q60: The basis of personal use property converted

Q62: Discuss the application of holding period rules

Q64: In determining the amount of the AMT

Q71: An individual generally may claim a credit

Q106: Lily exchanges a building she uses in

Q125: Mauve,Inc.,has the following for 2011,2012,and 2013 and