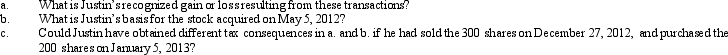

Justin owns 1,000 shares of Oriole Corporation common stock (adjusted basis of $9,800).On April 27,2012,he sells 300 shares for $2,800,while on May 5,2012,he purchases 200 shares for $2,500.

Definitions:

Finger-like Projections

Extensions found on the surface of certain cells or within bodily organs that increase surface area for absorption or sensory perception.

Mucosa

The moist, inner lining of some organs and body cavities, such as the nose, mouth, lungs, and stomach.

Villi

Small fingerlike projections that extend into the lumen of the small intestine, increasing its surface area for absorption.

Medial Margin

The edge or boundary closest to the midline of the body or a body part.

Q8: Samantha gives her son,Steve,stock (basis of $72,000;

Q9: The surrender of depreciated boot (fair market

Q13: On December 31,2012,Lynette used her credit card

Q14: At a particular point in time,a taxpayer

Q22: Phil's father died on January 10,2012.The father

Q33: Section 1245 depreciation recapture potential does not

Q36: Section 1245 generally recaptures as ordinary income

Q88: Which of the following statements is correct?<br>A)

Q95: If the AMT base is greater than

Q153: The fair market value of property received