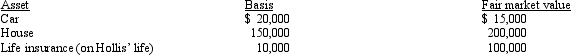

Henrietta and Hollis have been married for 10 years when Hollis dies in a sky-diving accident.Their assets are summarized below.  Henrietta and Hollis reside in Wisconsin,a community property state.All of the assets were acquired with community funds and pass to Henrietta.Her basis for each of the assets becomes:

Henrietta and Hollis reside in Wisconsin,a community property state.All of the assets were acquired with community funds and pass to Henrietta.Her basis for each of the assets becomes:

Car House Cash from life insurance proceeds

Definitions:

All Inclusive

A type of accommodation or vacation package deal where the price includes most or all amenities, meals, and activities.

Location

A particular place or position, often considered in a geographical or spatial context.

Supervisee

An individual under the direction or guidance of a supervisor, often in contexts such as education, counseling, or professional training.

Supervision

The act of overseeing or directing work or workers.

Q3: As a general rule,the sale or exchange

Q12: For the ACE adjustment,discuss the relationship between

Q14: Discuss the tax year in which an

Q18: Verway,Inc.,has a 2012 net § 1231 gain

Q48: Virginia,who is single,sells her principal residence (adjusted

Q57: Which of the following assets held by

Q60: The basis of personal use property converted

Q66: Letha incurred a $1,600 prepayment penalty to

Q112: The nonrecognition of gains and losses under

Q119: Which of the following best describes the