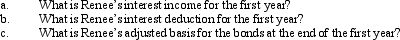

Renee purchases taxable bonds with a face value of $200,000 for $212,000.The annual interest paid on the bonds is $10,000.Assume Renee elects to amortize the bond premium.The total premium amortization for the first year is $1,600.

Definitions:

Physician

A healthcare professional who is trained and licensed to practice medicine, including diagnosing illnesses and prescribing treatments.

Medicaid Payment

Financial reimbursements made by Medicaid, a government program, for healthcare services provided to eligible individuals.

Allowable Fee

The maximum amount a health insurance plan will consider paying for a covered service or procedure, which may differ from what a healthcare provider charges.

Healthcare Provider

A professional or organization that provides health care services to individuals, including doctors, nurses, hospitals, and clinics.

Q8: In applying the lower of cost or

Q25: The sale of business property might result

Q33: The installment method can be used for

Q46: Some foreign taxes do not qualify for

Q55: Child and dependent care expenses do not

Q86: Ivory Fast Delivery Company,an accrual basis taxpayer,frequently

Q102: An employer calculates the amount of income

Q102: Moore incurred circulation expenditures of $300,000 in

Q112: In terms of the withholding procedures,which statement

Q133: Hilary receives $10,000 for a 15-foot wide