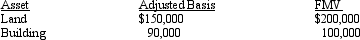

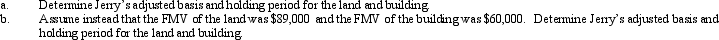

On September 18,2012,Jerry received land and a building from Ted as a gift.Ted had purchased the land and building on March 5,2009,and his adjusted basis and the fair market value at the date of the gift were as follows:

Ted paid gift tax on the transfer to Jerry of $96,000.

Ted paid gift tax on the transfer to Jerry of $96,000.

Definitions:

Factory Overhead Cost

Expenses related to producing goods that are not directly traceable to products, including utilities and manager salaries at a production facility.

Factory Burden

Another term for manufacturing overhead or factory overhead.

Materials Inventory

The cost of materials that have not yet entered into the manufacturing process.

Manufacturing Process

The sequence of operations that transforms raw materials into finished goods, involving tasks such as machining, assembly, and quality control.

Q9: When qualified residence interest exceeds qualified housing

Q18: List the taxpayers that are subject to

Q27: Match the treatment for the following types

Q33: Joyce,a farmer,has the following events occur during

Q76: The credit for child and dependent care

Q84: To qualify for the § 121 exclusion,the

Q85: Which of the following factors should be

Q94: Purple Corporation,a personal service corporation (PSC),adopted a

Q103: For purposes of computing the credit for

Q122: The maximum credit for child and dependent