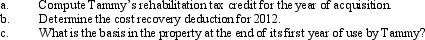

In January 2012,Tammy acquired an office building in downtown Syracuse,New York for $400,000.The building was originally constructed in 1932.Of the $400,000 cost,$40,000 was allocated to the land.Tammy immediately placed the building into service,but quickly realized that substantial renovation would be required to keep and attract new tenants.The renovations,costing $600,000,were of the type that qualifies for the rehabilitation credit.The improvements were completed in October 2012.

Definitions:

Fiduciary Duty

A legal obligation of one party to act in the best interest of another when entrusted with care of money, property, or sensitive information.

Employment

A formal relationship between an employer and an employee in which work is performed in exchange for compensation.

Restrictive Covenants

Clauses in a contract that impose restrictions on one or more parties' actions, commonly used in employment and real estate agreements.

Anton Piller Order

A court order that permits the plaintiff to search premises and seize evidence without prior warning, to prevent the destruction of relevant documents or items.

Q14: Tom has owned 40 shares of Orange

Q30: The purpose of the work opportunity tax

Q57: Mike is a self-employed TV technician.He is

Q75: In applying the percentage limitations,carryovers of charitable

Q81: If a taxpayer purchases a business and

Q103: What effect does a deductible casualty loss

Q104: Federal excise taxes that are no longer

Q110: How can interest on a private activity

Q127: Mandy and Greta form Tan,Inc.,by transferring the

Q146: Julius,a married taxpayer,makes gifts to each of