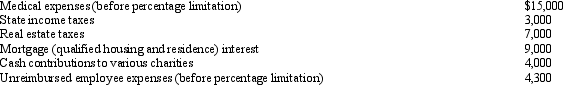

Mitch,who is single and has no dependents,had AGI of $100,000 in 2012.His potential itemized deductions were as follows:  What is the amount of Mitch's AMT adjustment for itemized deductions for 2012?

What is the amount of Mitch's AMT adjustment for itemized deductions for 2012?

Definitions:

Millions

A numeral representation indicating one thousand times one thousand, or 1,000,000.

Non-Cash Expenses

Expenses recorded on an income statement that do not involve a direct cash outflow, such as depreciation.

Millions

A numerical value or unit representing one million units of a currency or indicating a quantity of one million in number.

Cash Flow

The total accounting of funds moving in and out of a business, directly affecting its capability to remain solvent.

Q30: Joe,a cash basis taxpayer,took out a 12-month

Q32: Zeke made the following donations to qualified

Q46: Some foreign taxes do not qualify for

Q51: Gabe's office building (adjusted basis of $430,000;

Q69: An exchange of two items of personal

Q70: Wallace owns a construction company that builds

Q74: Prior to the effect of tax credits,Wayne's

Q84: Mona inherits her mother's personal residence,which she

Q98: If the taxpayer qualifies under § 1033

Q144: Before the Sixteenth Amendment to the Constitution