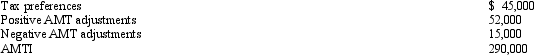

Use the following selected data to calculate Devon's taxable income.

Definitions:

Medical Services

These refer to the diagnostic, therapeutic, and rehabilitative services provided by health professionals to treat patients and maintain their well-being.

Third Party

An entity that is involved in a transaction or agreement but is neither the principal nor the direct beneficiary, often providing intermediary services.

Incentive

An incentive is a stimulus or mechanism implemented to motivate individuals or entities to take certain actions or make specific decisions.

Tax System

The organized method by which a government or authority levies and collects taxes from individuals and businesses.

Q8: Harry and Wilma are married and file

Q9: Under what circumstances will a distribution by

Q25: Which of the following is correct?<br>A) The

Q35: In May 2012,Blue Corporation hired Camilla,Jolene,and Tyrone,all

Q46: A statutory employee is not a common

Q46: For disallowed losses on related-party transactions,who has

Q60: The earned income credit is available only

Q92: Janet,age 68,sells her principal residence for $500,000.She

Q107: After 5 years of marriage,Dave and Janet

Q116: George and Martha are married and file