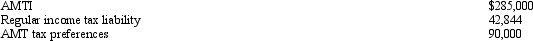

Caroline and Clint are married,have no dependents,and file a joint return in 2012.Use the following selected data to calculate their Federal income tax liability.

Definitions:

Strategic Buffer

A tactic or method used in communication to mitigate potential negativity or soften the delivery of a message.

Bad-News Message

A type of communication that delivers unfavorable or disappointing information to the recipient.

Indirect Claim Message

A communication approach that presents a complaint or request in a less confrontational manner, typically by explaining the context and significance before stating the actual claim.

Claim Message

A communication that makes a request for action or change due to dissatisfaction or a discrepancy.

Q6: Luke's itemized deductions in calculating taxable income

Q9: George and Jill are husband and wife,ages

Q25: A lack of compliance in the payment

Q35: The civil fraud penalty can entail large

Q78: For the tax year 2012,Andrew reported gross

Q83: Jack sold a personal residence to Steven

Q105: If an income tax return is not

Q112: Using the choices provided below,show the justification

Q117: Purchased goodwill is assigned a basis equal

Q124: Eunice Jean exchanges land held for investment